Workshop Information

The Maygarden Center for Financial Literacy offers free workshops that are open to the community.

Workshops are led by the Maygarden Center’s certified credit counselors or by financial professionals from organizations in the community.

If you are interested in requesting a workshop, please contact the Maygarden Center for Financial Literacy at financialliteracy@uwf.edu or 850.474.2353.

Upcoming Events:

The Center for Financial Literacy is proud to partner with Gulf Winds Cares Foundation to provide a series of quarterly workshops available for free to the community. Please stay tuned for details on the 2024-25 workshops.

Previous Workshops

Don't Get Hustled by Your Side Hustle

- March 18, 2024

- UWF Conference Center, Conference Room A

- Kyle Polhlopek, financial analyst, Gulf Winds Credit Union

How to Finance and Shop for a Car

- November 7, 2023

- UWF Conference Center, Conference Room A

- Daniel Arney, Gulf Winds Member Advocate Expert

First-Time Homebuyer Workshop

- September 19, 2023

- UWF Conference Center, Conference Room A

- Katrinka Phillips, Gulf Winds Mortgage Loan Originator

Better Credit Mo' Money: Do's, Don'ts and Nevers for Credit

- March 21, 2023

- Building 76A, Room 101

- Jim Eanes, Credit Consultant, Maygarden Center for Financial Literacy

Credit Scores and Building Credit

- January 25, 2022

- Building 76A, Room 101

- Greg Prescott, chair of the Accounting & Finance Department

- Credit Score Presentation

Personal Investing and Savings Products

- March 29, 2022

- Building 76A, Room 101

- Dr. Kwan-Chen Ma, professor of Accounting & Finance

Protecting Your Identity and Common Scams

- June 21, 2022

- Bowden Building, Room 1 (120 Church St.)

- Frank Higginbotham, financial crimes investigator for Escambia County Sheriff's Office; adjunct faculty member of Accounting & Finance

Becoming a 401K Millionaire

- October 24, 2022

- Building 76A, Room 101

- Greg Prescott, Department of Accounting & Finance Chair

- Becoming a 401k Millionaire

Navigating the Home Loan Process

- November 16, 2022

- Bowden Building, Room 1 (120 Church St.)

- Rich Preston

- Navigating the Home Loan Process

Putting Your Financial House in Order

- January 24, 2023

- The Commons Auditorium

- Chris Kelly, Senior Vice President, The Kelly Group at Morgan Stanley

The following are examples of topics that can be covered in a workshop.

40 Money Management Tips

- Every College Student Should Know

- This workshop, based on National Endowment for Financial Education’s popular publication 40 Money Management Tips Every College Student Should Know covers goal setting, financial aid, bank accounts, spending plans, credit, debt, savings and identity theft.

Income, Savings and Assets and Your Spending, Your Savings, Your Future

- Achieving Financial Stability for the Future

- Help low-income families increase income, build savings, and gain assets to improve financial stability.

- Guide to Financial Readiness

- Help people gain money management skills with a basic approach to spending, saving, and planning.

Money Potholes

- Becoming Financially Independent

- Help college students recognize common money traps and manage their money to avoid having to react to a lack of funds.

Credit Report

- What You Need to Know

- This workshop presents information to help people in all phases of life demystify the credit report and related credit score.

Dealing With Debt

- For College Students

- Provide college students practical tips to manage debt, avoid quick fixes, and plan to resolve financial trouble.

Car Buying

- Put Yourself in the Driver’s Seat

- Guide participants through each step of the car-buying process

Making Smart Decisions About Payroll Deductions

- This workshop is designed to help individuals make informed decisions about paycheck deductions for taxes and employee benefits, such as health care and retirement funds.

- Beware the Trails You Leave Behind

Preventing Identity Theft and Protecting Against Common Types of Fraud

- Recognize, Respond and Prevent

- Help families recognize, respond and take steps to prevent common types of fraud such as identity theft, credit card fraud and online fraud.

- Help college students understand the risk of identity theft,

- Receive steps to take if they become victims.

Generations United

- Reflect Your Financial Values

- Present ways to initiate conversations around personal finance with youth and young adults, while also including family and cultural stories.

Family Money Skills

- Basic Tools for Financial Success

- Help low-literacy families gain the critical life skills needed to make smart financial choices.

Previous Workshops

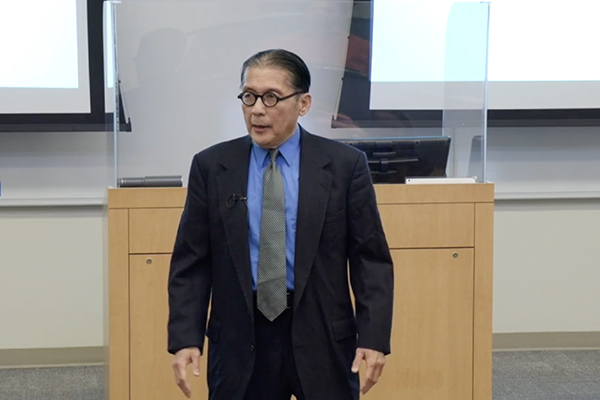

Personal Investing and Saving

with Dr. K.C. Ma, Professor of Accounting and Finance

University of West Florida

Credit Scores and Building Credit

with Dr. Greg Prescott, Chair of the Department of Accounting and Finance

UWF College of Business

Becoming a 401K Millionaire

with Dr. Greg Prescott, Chair of the Department of Accounting and Finance

UWF College of Business

Navigating the Home Loan Process

with Rich Preston, Branch Manager

NEXA Mortgage